Facing a tax audit or investigation can be daunting, but with Humanology Sdn Bhd by your side, your business can approach it with confidence and clarity. With an executive team led by Dato’ Sri Dr. Mohd Nizom Sairi, former CEO of the Inland Revenue Board of Malaysia (LHDN), and a seasoned group of retired LHDN professionals, Humanology provides an unmatched advantage in navigating these processes. Our insider understanding of Malaysia’s tax system, combined with our technical expertise and strategic know-how, positions us as your ideal partner in audit and investigation management.

Why Trust Humanology Sdn Bhd for Tax Audit and Investigation?

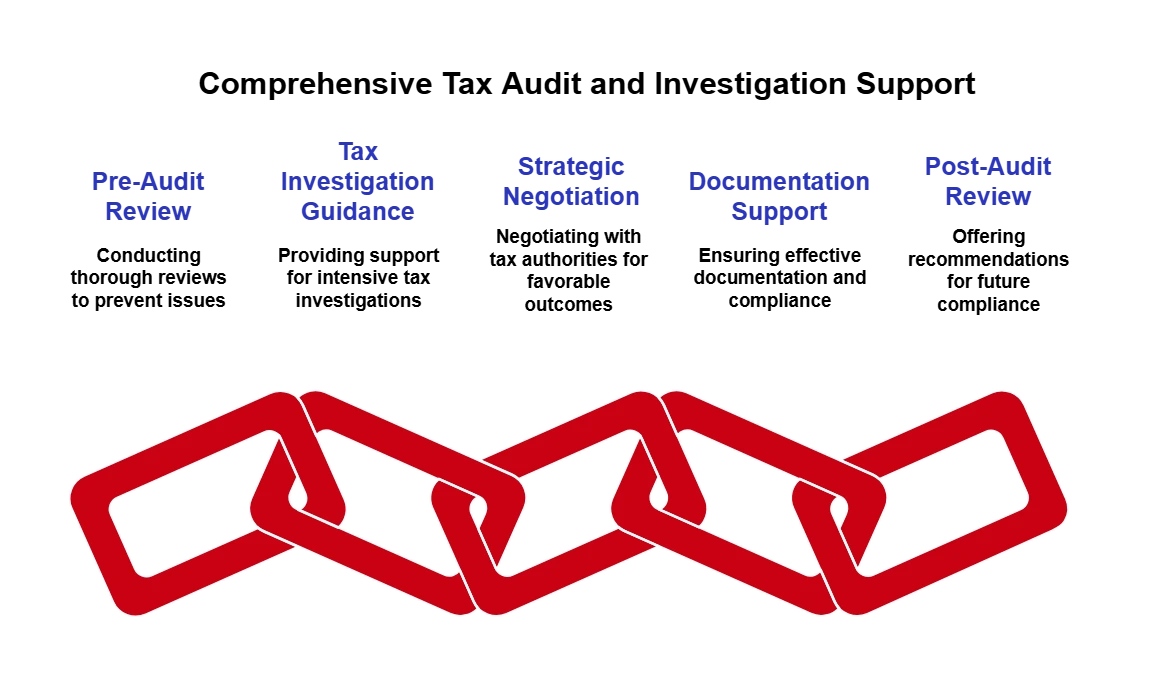

Humanology Sdn Bhd brings unique insights from within the LHDN itself. Our team understands precisely what tax authorities look for during audits and investigations, allowing us to prepare your business effectively, mitigate risks, and resolve issues quickly. Our Tax Audit and Investigation services include:

- Comprehensive Pre-Audit Review and Preparation

Our team conducts a thorough pre-audit review to identify and address any areas that could trigger scrutiny or misinterpretation. We evaluate your tax returns, records, and accounting practices to ensure that everything aligns with Malaysia’s Income Tax Act and other relevant tax laws, helping you present a clear and accurate tax position. - Guidance Through Tax Investigations

Tax investigations differ from routine audits and often require a more intensive examination of records. Humanology provides the experienced support necessary to handle such investigations effectively. Our team assists with gathering required documents, explaining complex issues, and guiding you through every stage to ensure that your interests are protected. - Strategic Negotiation and Representation

During audits or investigations, negotiation with tax authorities may become necessary to resolve disputes or clarify positions. With years of experience inside LHDN, our professionals provide knowledgeable representation, helping you communicate effectively with auditors, negotiate outcomes, and achieve favorable resolutions. - Documentation and Compliance Support

Effective documentation is critical during audits. We help you organize and prepare the necessary documentation, ensuring compliance with Malaysian tax laws and preparing supporting materials that demonstrate your adherence to tax obligations. From income records to expense claims, we help present a complete, accurate, and clear picture to auditors. - Post-Audit and Investigation Review

After an audit or investigation, our support continues. We offer detailed reports and recommendations to help you strengthen your compliance systems, mitigate future risks, and improve audit readiness. Our goal is to leave your business in a stronger compliance position, minimizing the chance of future issues with LHDN.

At Humanology Sdn Bhd, our team’s insider perspective from their years within LHDN means we understand the intricacies and nuances of tax audits and investigations in Malaysia like no one else. Let us help you navigate these challenging processes with confidence, accuracy, and the peace of mind that comes from having veteran experts on your side.